The key to successful digital transformation

Hardly any area is currently changing as rapidly as the tax law requirements surrounding electronic invoices and reporting.

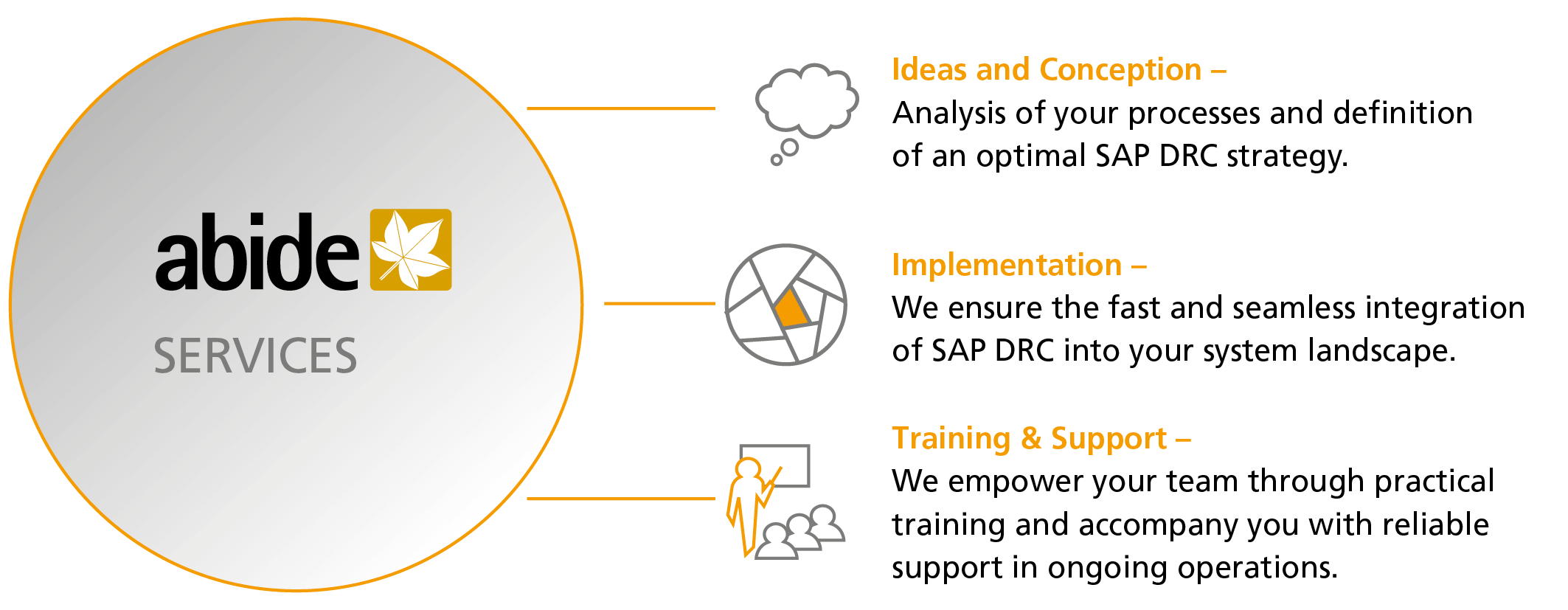

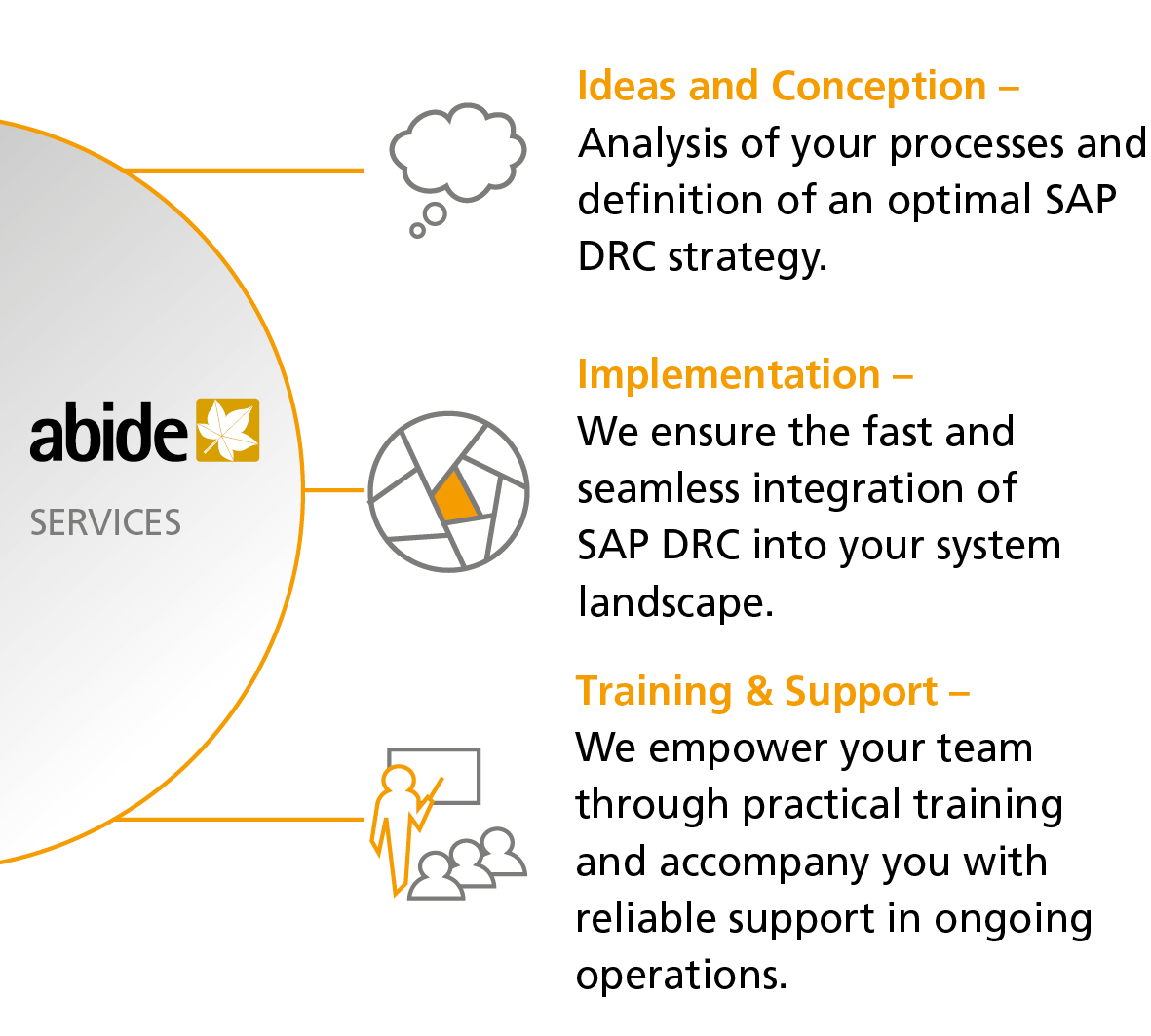

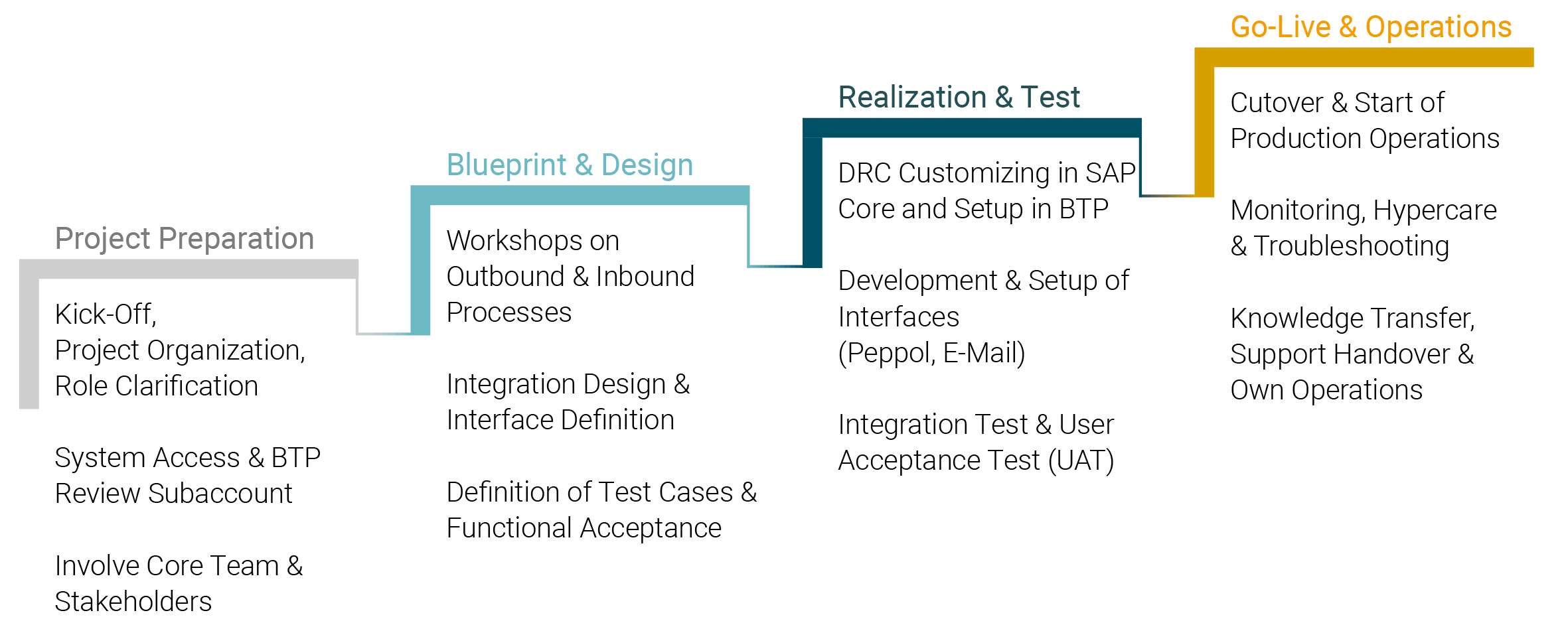

New regulations, short deadlines, complex formats: companies are under constant pressure. With SAP Document and Reporting Compliance (SAP DRC), you can implement legal requirements worldwide in a secure, fast, and centralized way. The solution integrates seamlessly into your SAP business processes and provides full transparency over all documents and reports – from creation to submission to the authorities.

SAP DRC does not only cover electronic invoicing. The solution also supports extensive statutory reporting obligations, such as VAT declarations, EC Sales Lists, periodic tax reports, or country-specific documentation requirements. Through its ability to integrate directly with governmental platforms, SAP DRC enables a seamless, efficient, and reliable exchange of the required information. As a result, numerous processes that are still carried out manually in many places today are fundamentally modernized. Companies benefit from higher data quality, reduced processing effort, and a significantly faster implementation of new legal requirements – all within a central, scalable solution.